Flexible content, always to the point

Compliance training money laundering

Flexible content, always to the point

2.000+ customers place their trust in us – from startups to large companies

Our compliance training on money laundering and terrorist financing covers all the important points that employees of banks and financial institutions need to be aware of.

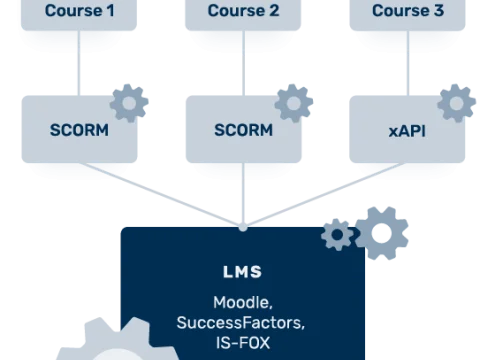

If your company doesn't yet have its own learning management system to deliver our content, we can offer you our popular IS-FOX learning management system.

If you would like to first understand what a learning management system does and why it is necessary, we recommend our know-how article E-learning fundamentals.

This training course was created in cooperation with compliance specialists of a large German financial institution. All content has been legally checked and approved.

Our training courses include compact videos, interactive exercises and a final test with an optional certificate. Also available as refresher training to brush up existing knowledge.

You're welcome to use our videos outside of training as well, e.g. on your company's intranet or at face-to-face events. This comes at no additional cost for you.

What makes our trainings outstanding?

We are really good at one thing: getting to the heart of compliance content. Not a legal radio play, but simple, clear messages. We convey the topic of money laundering in 25 minutes, where others need over an hour. Participants love that and it sticks better.

Not a legal radio play, but simple, clear messages.

You can customise the content. Not just the layout, but also due diligence obligations, reporting channels, scenarios, tools used and additional information. Everything is included in standard customising.

Customisations included in standard customising.

You can also use the videos ‘Basics of money laundering prevention’, ‘Due diligence obligations’ and ‘Warning signs of money laundering or terrorist financing’ outside of the training / e-learning, for example in your intranet portal or in a face-to-face event. At no additional cost. So that the really good content is not only viewed once a year in the mandatory training, but every day when you need it.

Videos for the intranet, at no extra cost

We cover almost all compliance topics, in six business languages, with different learning paths on request (refresher or test-out option), as a rental or purchase model, for your own LMS or in our cloud.

Basic course, refresher path, test-out option, for hire or purchase.

Money laundering means - to put it bluntly - turning dirty money into clean money. In this case, dirty means money that comes from illegal, criminal activities, such as drug trafficking, arms smuggling, extortion or corruption. And ‘laundering’ refers to the channelling of money into the legal economic cycle. The actual money laundering is therefore always preceded by a criminal offence from which the money or other assets originate.

A drug baron cannot simply deposit a few million in cash into his account inconspicuously. And a corrupt person cannot simply have bribe money transferred to their account. So criminals have to be inventive. And they are! They buy art and antiques in cash and sell the items at auctions years later. Or they pay for property in cash and later sell it again quite legally. Or they set up companies and mix the illegal money into their turnover.

Terrorist financing is about making funds available for terrorist purposes. Whether these funds were originally legal or illegal is irrelevant, it only depends on how they are used. Here too, criminals are very inventive. They take out life insurance policies on people abroad and then let them die. Or they set up aid organisations in third countries and transfer donations.

Combating money laundering and terrorist financing is not only a clear legal requirement, but also an important contribution to preserving our system of values, because money laundering and terrorist financing undermine the foundations of our constitutional state.

Felxibly combine content

The e-learning course on the prevention of money laundering and terrorist financing is aimed at employees of a bank or financial institution.

You can also download further compliance modules for employees, for example in the areas of ‘Code of Conduct’, AGG, money laundering, whistleblowing or fraud.

The right e-learning solution for every case

You put together your own customised content, we deliver the e-learning: naturally adapted to your compliance guidelines and corporate design, in the languages you need.

You can then run the finished online training course, including a test, via your company's learning management system or in our cloud - or both, if you wish.

Demos? Prices? References?

Get a free demo account and let's talk about your needs in a web meeting. We'll show you which trainings we have successfully used in comparable customer situations.

E-learning course for all employees or specific target groups.

E-learning course for all employees or specific target groups

Modern compliance online trainings make your employees compliance savvy on the most important topics. Find out more and get a free demo now!

How to repackage familiar GDPR content into exciting online courses.

Find out how companies can properly motivate their employees to complete an e-learning course on cyber security, data protection or compliance.

In this article, we explain the technical terms Scorm, LMS and e-learning course.

Everything important about whistleblowing in a 9-minute learning nugget.