Compliance & integrity: the essentials

Explained in a simple and comprehensive way.

Explained in a simple and comprehensive way.

"Compliance" and integrity are fuzzy terms to many people. Rightly so. After all, they refer to "conduct that complies with laws and regulations or values and responsibilities". But: What does that actually mean?

Compliance means the adherence to laws, regulations and internal policies, while Integrity reflects a company's ethical behavior and moral responsibility. Together, they form a strong foundation for responsible corporate governance.

However, compliance and training compliance-relevant topics is becoming increasingly difficult due to new legal guidelines (e.g. the Whistleblower Protection Act; Supply Chain Act). To meet these challenges and maintain the trust of customers, investors and the public, compliance and integrity need to be well understood and backed up by appropriate processes, tools and awareness initiatives.

In this article, we look at the essentials of compliance and integrity. In addition: How can you facilitate compliant behavior and prevent violations?

The minimum requirement for companies is to comply with relevant legislation. This avoids legal consequences and reputational damage and is the first step towards ethical business practice and constructive business relationships.

Specific measures to protect sensitive data include the need-to-know principle, strict compliance with the GDPR, and information classification. These safeguards protect confidential and personal information and reduce data protection risks or the compromise of internal business-critical data.

With the help of appropriate control mechanisms, transaction monitoring systems and well-trained personnel, companies can identify and report money laundering activities at an early stage and avoid or contain a compliance violation. This not only helps to avoid legal consequences, but also protects the company itself from abuse through criminal activities.

Equal treatment and the protection of employees against discrimination are an important part of compliance. The General Equal Treatment Act (German abbreviation: AGG) requires companies to protect their employees from discrimination, harassment and unfair treatment. In addition, equal treatment creates a positive work environment and promotes an inclusive, tolerant and respectful conduct among all people in a company.

Compliance-based behavior as practiced within a company should also apply toward customers and business partners. This includes, for example, ethical standards relating to contracts, agreements and transparent business practices in order to minimize the risk of fraud, corruption and other criminal business practices and to build long-term relationships based on trust.

Companies should establish clear policies and procedures for dealing with insider information to avoid conflicts of interest and illegal actions. Insider trading refers to trading in shares on the basis of non-public information and is prohibited by law. This makes insider trading an absolute no-go and violates the integrity of a company and the capital market as a whole.

Donations and sponsorship are not wrong per se. What matters is the correct way of handling them: By managing donations and sponsoring in a transparent and responsible way, companies strengthen their reputation and prevent potential conflicts of interest. This also minimizes the risk of undue influence or conflict of interest. Speaking of conflicts of interest ...

While money laundering and corruption are strictly prohibited, conflicts of interest and benefits are considerably less straightforward to deal with in individual cases.

Generally, a conflict of interest arises whenever the judgment of a decision-maker is impaired. On this basis alone, there is already a risk of undue influence.

Typical examples:

In addition, other professional activities of employees, financial interests of management and the acceptance of benefits have to be critically assessed. These situations can already influence objective action and decision-making and thus contradict the principles of compliance and integrity.

When it comes to benefits, the gray area becomes even more opaque. Here, ideally, one can rely on an internal policy on benefits and, alternatively, on a pinch of common sense. But there are also definite no-go's, such as cash or cash equivalent gifts or favors for or from business partners.

| Usually unproblematic | Review required | Usually prohibited |

|---|---|---|

| Gifts of little value (e.g. pens) | Higer value gifts in kind (e.g. wine, electronics, clothing) | Cash or equivalent (cash checks, gift cards, vouchers) |

| Business Lunch (during working hours) | Dinner invitations (within reasonable limits) | Extravagant hospitality / invitation without business reference |

| Specialized event with exclusively business-related topics | Mixed event: Business with a certain (not predominant) share of entertainment | Entertainment event (without reference to the presentation of our products and services) |

Beware of special regulations for public and elected officials or representatives:

As a rule of thumb, individuals from public administration, state-owned companies, or from politics and the judiciary may not receive any gifts, invitations, etc. Such benefits can quickly be regarded as attempted bribery and thus be punishable by law.

If in doubt, please always contact your compliance officer.

In the effort to combat compliance vulnerabilities, companies have a variety of measures at their disposal that can help organizations embed compliance and integrity in all areas of their business.

A Code of Conduct is developed on the basis of the legal foundations and translates them into everyday business, for example through concrete standards and expectations of behavior for all employees. A code of conduct thus serves as a guideline for compliant behavior in everyday business and promotes ethical and lawful conduct.

Training courses such as our compliance training are an efficient solution for giving your employees the necessary legal and risk awareness. This equips them with the knowledge needed to recognize and avoid potential risks and respond appropriately. In this way, you minimize violations and promote a company-wide compliance culture.

Internal compliance controls (e.g. dual control principle) and the recording of compliance-relevant processes in systems support the identification, monitoring and minimization of risks and serve as evidence of a company's compliance measures. In addition, a compliance management system supports employees in evaluating compliance-relevant incidents by providing clear guidelines and a framework for action for implementation in everyday life.

Under the Whistleblower Protection Act, larger companies must set up secure reporting channels for whistleblowers and treat incoming tips confidentially. As a result, whistleblowers remain anonymous if they wish and do not have to fear any reprisals to their person or workplace. Establishing a whistleblower system enables employees and external parties to report violations or suspected cases anonymously. This can contribute to the early detection of misconduct and promote a transparent and trusting compliance culture.

Ignorance is no excuse. That's why compliance and all its nuances must be properly understood. The best way to reach the necessary level of compliance awareness is through a training course that presents complex issues in an easy-to-understand way and provides concrete recommendations for action in day-to-day work. Only when there is an understanding of compliance requirements they can be adhered to and lived by, and potential abuses can be quickly discovered and prevented.

And it pays off. And not just by having legal security - after all, you'll want to avoid penalties in the first place. But a strong compliance culture also ensures a productive working environment and a trustful cooperation with customers, partners and investors.

Reasons enough to address compliance and the awareness of your employees around behaving with integrity and confidence. Trainings like our IS-FOX Compliance Training equip them with the knowledge they need to understand compliance requirements and make ethical decisions. And all without legal jargon and dry theory but with fun and applicable recommendations for action.

Get a free demo account now and let's talk about your individual needs in a web meeting. We'll show you how to successfully strengthen compliance in your company through employee training.

Modern compliance online trainings make your employees compliance savvy on the most important topics. Find out more and get a free demo now!

E-learning course for all employees or specific target groups.

E-learning course for all employees or specific target groups

Compliance training Prevention of money laundering and terrorist financing. E-learning modules for employees of banks / financial institutions

Everything important about whistleblowing in a 9-minute learning nugget.

Export control is essential for compliance in international trade and regulates the export of goods & technologies.

The German "Supply Chain Act" explained in a simple and comprehensive way.

The General Equal Treatment Act (AGG) at a glance: What employers need to know.

Corruption & fraud – small "favors" can quickly become crimes.

Find out how companies can properly motivate their employees to complete an e-learning course on cyber security, data protection or compliance.

How to repackage familiar GDPR content into exciting online courses.

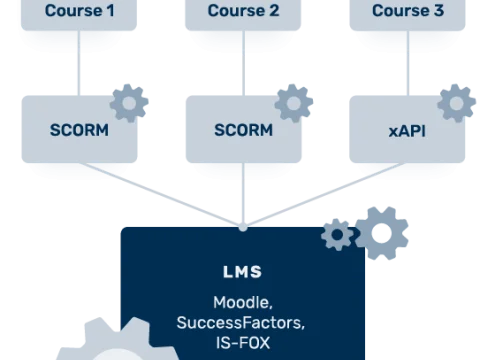

In this article, we explain the technical terms Scorm, LMS and e-learning course.